SHOCKING: Kanye West was suspended from Instagram immediately after making rude comments about Trevor Noah, South Africans were outraged when they learned the truth…/hi

Kanye West suspended from Instagram after slur against Trevor Noah This article is more than 2 years old West used racial slur after Noah criticised his behaviour…

BREAKING NEWS: Trevor Noah did this for Jordyn Taylor while she was struggling with the pain of a great loss../hi

Trevor Noah strolls with new model girlfriend Jordyn Taylor, as her heartbreak after her fiancé was killed in a freak car accident is revealed Smitten Trevor Noah…

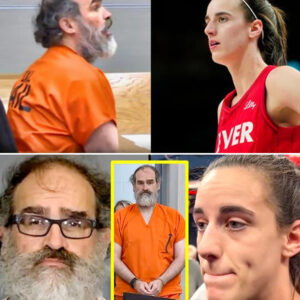

“Guilty as Charged!” – The Chilling First Words of Caitlin Clark’s Alleged Stalker in Court

A jaw-dropping moment has erupted online as a video surfaces showing the first words spoken in court by Michael Thomas Lewis, the man accused of stalking WNBA…

‘No way’ – Sophie Cunningham turns heads with Caitlin Clark-inspired outfit before Indiana Fever go on to lose

WNBA star Sophie Cunningham stunned fans with a Caitlin Clark-inspired outfit before their team’s eventual loss on Sunday. Cunningham, 28, has been in the spotlight since…

Sophie Cunningham slams WNBA referees for not protecting ‘star player’ Caitlin Clark after Indiana Fever bust-up

WNBA star Sophie Cunningham has launched a stunning attack on referees for failing to protect the league’s top talent. The 28-year-old Indiana Fever guard has been dubbed Caitlin…

New Gruesome Slo-Mo Video Shows Close-Up Of Tyrese Haliburton’s Achilles Exploding During Game 7 Of NBA Finals, And It Does Not Look Good

Tyrese Haliburton only had one more game to play this season, and he won’t be able to finish it. In the first quarter of Game 7 against the…

Simone Biles Speaks Out After Slamming Riley Gaines for Her Views on Transgender Athletes

Simone Biles is speaking out again after she slammed Riley Gaines for her views on transgender athletes in sports. Biles, 28, posted a lengthy message on X on Tuesday, June 10,…

Stephen A. Smith blew up the screen by calling Angel Reese a “jealous bully,” exposing her foul play and Caitlin Clark’s teasing. The backlash turned Reese into the WNBA’s new “villain” and fueled the question: Will her career crash before it really takes off?

The burgeoning rivalry between Angel Reese and Caitlin Clark has become a defining narrative of the early WNBA season, carrying the intensity of their college battles into…

Caitlin Clark Shuts Down Whoopi Goldberg On-Air With Just Five Words—Audience Left Speechless

What started as a routine media appearance for rising basketball star Caitlin Clark quickly turned into one of the most talked-about moments on daytime television. During an…

Danica Patrick Drops A Giant Truth Bomb On Simone Biles During Her Feud With Riley Gaines Over Transgender Athletes

Danica Patrick has made her opinion on Simone Biles extremely clear amid controversy. The former IndyCar and NASCAR driver proudly confessed to taking the “red pill” as the racing star…